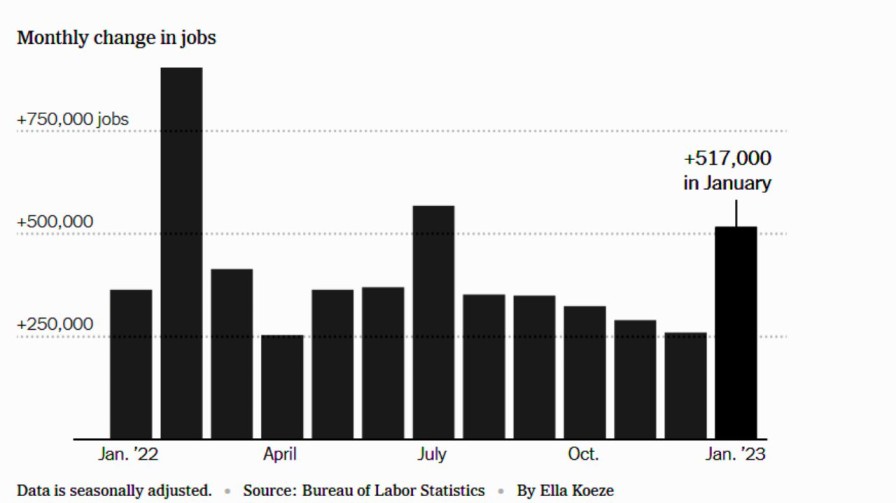

The unexpected findings highlighted the difficulties facing the Federal Reserve, which is attempting to calm the labour market to combat inflation.a gentle landing The work market in America is still booming.Employers launched a surprise burst of hiring in January, creating 517,000 positions on a seasonally adjusted basis, the Labor Department said on Friday, after months of gradual but steady drops in employment creation.

U.S. Hiring Increases

The gain was the biggest since July, and experts familiar with labour market patterns, who had been anticipating another month of slow cooling, were in awe of it.Beth Ann Bovino, the head U.S. economist at S&P Global Ratings, said, “So much for moderation!” We undoubtedly missed it in this report.

The unemployment rate dropped to 3.4 percent, the lowest level since 1969, underscoring the job market’s incredible vigour.

However, salary growth remained mild even as employers hired with a strike-breaking zeal in January — or at least fired fewer seasonal employees than in other years. The average hourly wage grew 4.4 percent over the last year and 0.3 percent from December, suggesting that some of the pressure to attract workers with pay increases may be diminishing.

Along with inflation, wage growth is declining.

In remarks at the White House, President Biden declared, “Put simply, I would say the Biden economic plan is succeeding,” dismissing the “chorus of detractors” who had criticised it.

The substantial hiring numbers highlighted the difficulties the Federal Reserve has as it attempts to calm the job market in order to contain rapidly rising inflation. Policymakers believe that by raising interest rates—which Fed officials did on Wednesday for the seventh time in a year they will compel companies to cut down on expenditure, including employment.

The actions seemed to be calming the labour market, with little discomfort for workers. Despite a wave of pink slips from technological businesses, employment growth during the summer had slowed but remained around 250,000 per month, and layoffs were exceedingly rare.

There were other recent initiatives that gave cause for hope that the economy was escaping its rolling boil. End-of-year consumer spending decreased, indicating that Americans were finally acting more cautiously in the face of rising prices, shrinking savings, and recessionary worries. Although there has been some recent softening, the housing market seemed to be slowing down as high mortgage rates were making purchases prohibitively expensive for many would-be homeowners.

The hiring statistics for January imply that authorities may still need to undertake more effort to slow down the labour market’s pace and restore economic equilibrium.

According to the research, employment growth was widespread and even reached those industries that were predicted to stall as the effects of the Fed’s rate hikes spread across the labour market. Leading the charge were the pandemic-affected leisure and hospitality industries, including bars, restaurants, and hotels, which gained 128,000 jobs, and the health care industry, which added 58,000 jobs. Additionally, professional and commercial services increased their recruiting.

Government employment also saw a sizable increase, however this was mostly due to the return to work of striking University of California employees.

5,000 jobs in the information industry were lost. Given the recent headline-grabbing layoffs at technological behemoths like Microsoft and Google’s parent firm, Alphabet, even that was a mere blip.

A talent acquisition and advice company’s Nicola Hancock, managing director for the Americas area, asserted that there was a slowdown in several industries by the end of 2022. All of our clients are still recruiting, she noted. Industry sectors served by AMS include banking, financial services, technology, and pharmaceuticals.

Some new employment market tendencies that had suggested an oncoming economic slowdown appeared to reverse themselves, further confounding the story. Work hours increased across all industries, including manufacturing and construction. And after months of reductions, employment in the temporary help sector, which typically drops during economic uncertainty, increased by 26,000.The data from Friday’s report is provisional and will undergo at least two revisions.

At 62.4 percent, the labour force participation rate scarcely moved. In order to relax the tight labour market that is raising wages and fueling inflation, Fed policymakers have been wanting to see a rise in the number of people who are looking for work.

The labour force participation rate is still well below prepandemic norms.

Even if the news was perplexing, it also confirmed a widely held belief that the labour market is robust. After the turbulence caused by the pandemic’s beginning, employers’ plans haven’t really been drastically altered. Businesses have been in a rush to employ despite rising borrowing prices, giving salaries and a plethora of incentives to entice workers, buoyed by what seems to be an endless demand for products and services.

Without accounting for seasonal changes, 4.6 million new employment were added in 2016 — about 200,000 more than originally estimated and the second-highest number since records have been kept in 1939.

One potential explanation for the recent spike in hiring is that companies were more easily able to fill available positions since wage pressure had partly subsided.

According to Betsey Stevenson, a professor of economics and public policy at the University of Michigan, “basically, the hesitancy and misunderstanding that I think made it difficult for employers and employees to locate each other in the early phases of the recovery has started to abate.” Employers are more aware of the state of the labour market since more people are seeking for work.

In addition to the statistics on Friday, the government also published data this week indicating that there were 11 million more job opportunities in December. The ratio of jobs posted per available jobless worker a statistic that authorities have been keenly monitoring also rose.

According to Stephanie Miller, director of talent acquisition and retention at Express Employment International, an Oklahoma City-based staffing firm, some businesses who were previously unable to compete on salaries with larger firms are now in a favourable position.

Since everyone has been operating on a tight budget for so long, she claimed that few small- to medium-sized enterprises had surplus funds. They are simply remaining stable, advancing, and they will get through this.

In this instance, C&L Supreme of Des Plaines, Illinois, which manufactures component parts for machinery including document scanners and sorters, was involved. Even after eliminating an entire shift on the factory floor in 2021, the firm failed to find enough workers last year and mostly functioned with a manpower deficit, according to Tom Hacker, chairman of C&L Supreme.

No of how successful our firm was, we needed to fill roles, he remarked. He listed a variety of difficulties, including a dearth of suitable candidates, much like many other businesses.

But last month, according to Mr. Hacker, things suddenly started to pick up, and the business was able to add three people, bringing its workforce to roughly 35.

The job market or atmosphere was “actually sort of bizarre and unusual” after Covid and for the entire previous year, he claimed. For a few reasons, “I think that’s starting to calm down a little now.”

Many forecasts believe that the job market will deteriorate this year as the effects of increased interest rates become more apparent. Businesses nationwide “typically predicted minimal growth in the months ahead,” the Fed stated in its most recent region-by-region survey, known as the Beige Book.

However, it’s unclear if that will result in significant layoffs. After having trouble finding employees, many companies may be reluctant to fire them and instead try to make other adjustments, including providing less perks. Some analysts pointed out that the significant seasonally adjusted growth in jobs may have been aided by firms not laying off as many seasonal workers as is normal at the beginning of the year.

Gregory Daco, the head economist of EY-Parthenon, Ernst & Young’s strategy firm, said that business leaders were seeking for inventive methods to keep their labour expenses under control. “We’re not likely to experience the quick spike in layoffs that we did in previous cycles.”

As other firms wait to see what the upcoming months hold, they are becoming more selective in their hiring.

Although sales at Houston’s Forth & Nomad, a women’s lifestyle clothing and accessory retailer, climbed by 30% last year, Andy Sommer, the owner and CEO, expressed concern about adding too many employees until the state of the economy was more certain. He is thus attempting various scheduling strategies and hopes management can fill in any gaps while also seeking to replace the staff that departed after the holiday season.We simply don’t know if this is going to be a true downturn, he added. You just don’t want to overstaff and assume a rise in sales, only to find yourself in a difficult situation if it doesn’t materialise.